Bisq DAO Cycle 3

The figures on this page are compiled from data files generated by the Bisq software. You can verify everything yourself by running these scripts on GitHub.

Cycle Started17 Jun 2019 / Block 581107

Cycle Ended17 Jul 2019 / Block 585786

Supply Change+ 9,229

Governance20 of 21 proposals accepted

Network Funds Transfers

| BSQ Amount | # of transactions | |

|---|---|---|

| Burn | ||

| Trading fees² | 13,354 | 2,805 |

| Asset listing fees | 65 | 2 |

| Blind vote fees | 40 | 20 |

| Compensation request fees | 34 | 17 |

| Proposal fees | 8 | 4 |

| Total Burn | 13,501 | 3,024 |

| Issuance | ||

| Compensation³ | 22,730 | |

| Reimbursements⁴ | 0 | |

| Total Issuance | 22,730 | |

| Net BSQ Supply Change⁵ | +9,229 |

¹ Proof-of-burn includes trading fees paid in BTC and disputed BTC deposits for trades that went to arbitration (see docs for more details). Funds may be accrued and burned in different cycles, so proof-of-burn figures do not map directly to activity in their cycles.

² BSQ trading fees only. BTC trading fees are included in proof-of-burn.

³ See more details on GitHub.

⁴ Over time, the net impact of reimbursement issuances on BSQ supply is close to zero, as corresponding amounts of BTC are burned through proof-of-burn (see docs for more details).

⁵ Decreases in BSQ supply are good.

Governance

Parameter change proposal for DEFAULT_MAKER_FEE_BTC

Made by user deltahandler with this issue.

Accepted

Parameter change proposal for DEFAULT_TAKER_FEE_BTC

Made by user deltahandler with this issue.

Accepted

Parameter change proposal for DEFAULT_MAKER_FEE_BSQ

Made by user deltahandler with this issue.

Accepted

Parameter change proposal for DEFAULT_TAKER_FEE_BSQ

Made by user deltahandler with this issue.

Accepted

Notes

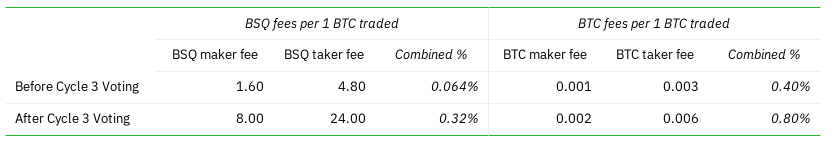

Following the continued strength of BSQ usage and trading, Cycle 3 voting resulted in another fee increase, this time for both BTC and BSQ fees. Full discussion is here on GitHub, but the basic reasoning was that strong BSQ markets, strong trading volume, and a need for the network to attract good developers made fee increases toward targets appropriate.

The fee schedule this voting cycle approved look like this:

Notes:

- Calculations for Cycle 3 assume a 10 000 USD/BTC rate.

- The BTC/USD rate increase meant BSQ trading fees would have needed an increase anyway. See point 4 of the Cycle 2 notes above for an explanation.

- Again, note the combined fee percentages. You'll see that BSQ fees after voting are still lower than the 0.4% target. You'll also see that the combined BSQ fee percentage before Cycle 3 voting is different than the combined BSQ fee percentage after Cycle 2 voting. This is because of the USD/BTC rate increase.

- BTC fees did change this time. As discussed in the issue, for BSQ fees to reach the 0.4% target, BTC fees will need to increase if a ≈50% discount for using BSQ is to be maintained. This means BTC fees need to reach a combined rate of 1% in the long-term (i.e, with maker and taker fees combined). This increase got BTC fees to 0.8% (0.006 + 0.002 = 0.008).