New issue

Have a question about this project? Sign up for a free GitHub account to open an issue and contact its maintainers and the community.

By clicking “Sign up for GitHub”, you agree to our terms of service and privacy statement. We’ll occasionally send you account related emails.

Already on GitHub? Sign in to your account

Keeping BSQ trading fee discount at 50% of BTC #202

Comments

|

I think this is good in principle, but would suggest that the fees could change by up to 20 percentage points per cycle, and it would only be done when the discount is 10 percentage points off the 50% mark. Having a very precise measure makes little sense since both BTC and BSQ prices are quite volatile. |

|

@sqrrm Thanks for taking a look at this proposal. Maybe I did not explain correctly how the numbers are calculated, or they're calculated in a strange way in the spreadsheet. I created a third sheet with the calculations of a sudden drop in BSQ price scenario to show how it would be.

The max discount difference of 5% variation means that if now the discount is 60%, for the next cycle it should be 55% for the nex. As it's calculated on the spreadsheet, implies that a maximum of a 13% BSQ increase is allowed.

Fees would have to be checked periodically anyway, so I think that a 5% distance from the mark should be used. For the DAO it's a simple vote for two parameters, as rules are already known and easy to check consulting the spreadsheet. For contributors and traders, keeping the discount the closer possible to 50% makes it easier to predict revenue and expenses. |

|

@sqrrm I changed the spreadsheet, now the BSQ variation is easier to understand. |

|

That's reasonable, gave my thumbs up. |

Update for cycle 12There's no need to update fees for Cycle 12. Current BSQ discount is 50.1%, into the 44-55% range. 7050 USD/BTC and 0.61 USD/BSQ has been used to calculate new fees. USD/BTC is bitcoinaverage price at this time, and USD/BSQ is weighted volume 30 day moving average as displayed in Bisq node v1.3.2 You can view the spreadsheet here I consider this proposal approved and voting not necessary. Changes are small and I have not seen opposition to it. The 15% cap on BSQ % raise might be the most controversial or subject to change aspect of this proposal, I consider this part of the proposal open for review in next cycles. @cbeams @mpolavieja Do you think that for next cycles, a new proposal should be open, or should this one be kept open? I think that Proposals is the best way to proceed with this. I'll do what you think it's best, and modify the wiki accordingly. |

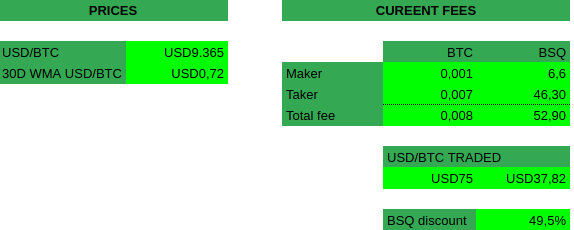

Cycle 13Prices used: 9620 USD/BTC and 0,63 USD/BSQ (30 day WMA) There's a need to update BSQ trading fees, as discount is over 55%. The 15% cap for BSQ trading fee increase will be used. New BSQ trading feesA change parameter request for BSQ trading fees will be submitted to DAO voting: Spreadsheet (cryptpad spreadsheet was broken due to a bug): https://docs.google.com/spreadsheets/d/1-hISy7F0NSqPnRxDOoi1k7df1qLJHfQTxhrVLt6NbX4/edit#gid=0 |

|

Yes, it's edited now. I'm waiting for lower mining fees to send the proposals to DAO. |

|

TXID for change parameter proposals: Edit: I did a mistake sending a wrong change parameter to vote and apparently remove proposal failed. Proposal with TXID |

|

After change parameter proposals were approved, I have updated the wiki page with the new BSQ trading fees. https://bisq.wiki/Trading_fees |

|

I'm reopening this proposal. The plan is to keep using this one until there's a need to update BSQ trading fees again. For more info, read the wiki or proceed to #compensation keybase Bisq channel. Cycle 14Parameters

There's no need to update BSQ trading fees for Cycle 14. |

|

Closed: new BSQ trading fees have been proposed for Cycle 15. |

Motivation

After approval of proposals #173 and #181 regarding trading fees, a process to keep BSQ discount up to date in a regular, systematic way is still needed.

Proposal

3 days before end of proposal phase, Compensation maintainer will use this spreadsheet to calculate current and, if needed, new BSQ trading fees. New BSQ trading fees will be submitted to DAO vote only when the discount is 5% over or under the 50% mark. To reduce trader impact in case of sudden BSQ price drop, (edited) max BSQ % variation for current and proposed fees should be a 15% increase (i.e. if current discount BSQ trading fees are 10 BSQ, max new BSQ trading fees should be 11.5 BSQ, even when that supposes leaving the discount over 50%).

The parameters used to calculate the discount will be USD/BSQ 30 day volume weighted average and current USD/BTC price as displayed in a Bisq node.

The process is detailed in the wiki.

Edit: Max BSQ % variation for current and proposed trading fees increase is 15%.

The text was updated successfully, but these errors were encountered: